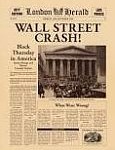

One does not have to look too hard or too far back to get a glimpse of the effects of an economic crisis. The most recent crisis in the Euro zone and the near collapse of the banking system in the US are still impacting our lives. But try to find witnesses of the 1929 stock market crash that ushered in the Great Depression, and you are bound to realize that people of that generation are a bit more scarce to come across these days. The same is true for finance books that were published around the time of the stock market crash of 1929; they are a bit rarer than the flood of economics books written since the beginning of the 2007 global financial crisis. That being said, where should the rare finance book collector be looking for value during these times of vast economic material?

Rare book sale activity for finance and investing as captured under the category of Business and Economics by our Rare Book Sale Monitor (RBSM) has been pitiful. This particular category has historically been extremely slow to change, and relatively lacking volatility or “sex appeal.” In fact since the launch of the RBSM data collection at the beginning of 2009, there has been little or no appreciation to the general pricing level for books in this genre. Do collectors of rare economics books hold back during bad economic times, or do such books tend to be closely correlated to the more fundamental rare book sale trend of “slow but steady?” For some answers to these questions one ought to look at the success stories that the sector has to offer.

Two books that are extremely collectible and capture the essence of the 1929 stock market crash, were published five years before and five years after the crash, respectively. In 1923, Edwin Lafevre wrote Reminiscences of a Stock Operator, New York: George H. Doran Company. The book is an account of the Wall Street experiences of a New England speculator by the name of Jesse Livermore, whose corrupt operations paint a detailed picture of the common practices in pre-crash investing in a less than perfect market. From 1920 to 1929, stocks more than quadrupled in value. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market until the bubble burst (a close resemblance to the internet bubble crash at the beginning of this century). Lafevre’s book captures the nature of the market that led to the exuberance in investing.

The decline that started in 1929 lasted until 1933, after the Federal Reserve and the banking system of the United States had largely ceased to function. Sound familiar? Stocks hit bottom, down about 80% from their highs in the late 1920s. In 1934, Benjamin Graham and David Dodd released the classic Security Analysis, New York: Whittlesey House / McGraw Hill. The book is still popular 80 years later, and has not gone out of print, selling close to a million copies. Considered to be the most influential book on investing is the result of the lessons learned post the crash that are still applicable today. It emphasizes the fundamental investment qualities of discipline, honesty and diligence for a successful investment strategy.

It is needless to point out that both first printings in original dust jackets are quite scarce. Usually priced at over $50,000, they each offer quite an investment gain for the few disciplined collectors that had the vision and courage to acquire the collectibles at a time when the future was bleak. History taught that during such economic times of uncertainty there are opportunities to be uncovered. What will the winner of collectibles be this time around? Keep tuned in; it may take a while.

{ 0 comments… add one now }

{ 5 trackbacks }